Application of Bowman’s Clock to Kraft Foods Inc:

This report will examine what generic strategy Kraft employs, the position this strategy takes on Bowman’s clock and whether Kraft’s generic strategy provides an effective competitive advantage.

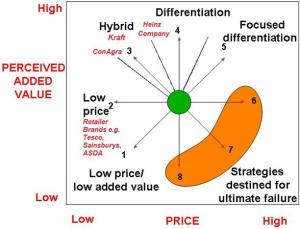

Through much research, Cliff Bowman and Richard D’Aveni developed what is now known as the ‘Bowman’s Clock’ (D’Aveni, 1995). This clock provides 8 different competitive positions, three of which are destined to fail (see diagram). Consumers have different expectations in terms of their value for money, which the clock reflects by comparing customers’ perceived value against price (Johnson et al, 2008). As with Porters generic strategies, Bowman accepts differentiation and focus alongside price. However, Bowman’s clock considers another way of analysing a company’s competitive advantage (Johnson et al, 1996). His research importantly found that most companies were combining best value at lower price, whilst seeking differentiation to the wide market. This Bowman identified as the hybrid strategy, which challenges Porters distinctive strategy and takes position 3 on the clock (Johnson et al, 1997).

For an indication of Kraft’s position on the clock depends upon the customer perceived value. Kraft mostly sell their products in bulk to supermarkets such as Tesco, Sainsbury’s and ASDA, this indicates that Kraft products are mostly sold to mid range distributors (Johnson et al, 2008). This suggests Kraft is not on position 4 or 5 as the company are not targeting a niche market because it is selling to large supermarkets and therefore attracting a wide customer base (see diagram). Certainly, Kraft is also not on positions 1, 2, 6, 7 and 8 as Kraft is a well recognised brand, which customers perceive to be of good value relatively priced (Gogoi 2010). Thus it appears that Kraft is on position 3 on the clock, which is the hybrid strategy. This is evident and supported by Kraft CEO Irene Rosenfeld who stated:

“… We’re benefiting from a virtuous cycle of growth and focused reinvestment… managing input costs by maintaining strong brand equities and pricing accordingly… driving productivity and reducing overhead cost to expand margins.” (Seeking Alpha, 2010)According to Gogoi (2010), Wal-Mart decision to reduce Kraft products and other national brands in stores led to a decline in Wal-Mart sales. This implies that customers may have gone to other distributors to buy Kraft products. Thus Kraft has been successful in differentiating products in terms of its value from low cost brands such as Wal-Mart. Hence Kraft’s main profits come from mid range distributors. Indeed, the takeover of Cadbury’s has enhanced Kraft’s economies of scale, which they already benefit from by selling in bulk to large supermarkets (Parsons, 2010). This helps build and sustain Kraft’s competitive advantage by keeping a low cost base.

However, this can prove to be detrimental to Kraft margins if for any reason these distributors decide to reduce or even stop Kraft products in store. CEO Irene Rosenfeld stated:

“We saw declines in a number of our non core biscuit brands… due to reduced merchandising at a key customer.” (Gogoi, 2010)This refers to Wal-Mart decision to reduce Kraft products and supports the view that although the hybrid strategy works to generate greater volumes, its main disadvantage is its heavy reliance on distributors to store the products (Andrejczak, 2010). Subsequently, Kraft has formed a rainforest alliance to protect ecosystems and wildlife and honoured the commitments of Cadbury cocoa partnership and fair-trade (Kraft, 2010). This undoubtedly differentiates Kraft from its low cost competitors, but also its domestic competitors such as Heinz and ConAgra. It seems therefore that Kraft hybrid strategy builds and sustains competitive advantage as it adapts to the current customer trend for more ethical products (David 2009).

Bowman’s clock therefore recognises a remarkable hybrid strategy, which clearly demonstrates that Kraft can differentiate itself, whilst maintaining low costs and ultimately achieving a competitive advantage. However, there is debate as to whether this strategy can be a successful competitive strategy, as there seems to be a constant compromise between low price and differentiation (D’Aveni 1995). Nonetheless it still helps managers understand their markets and make decisions over their positioning and competitive advantage (Johnson et al, 2008). It also assists them to renew or refresh a strategy. Thus the ‘clock’ is a useful tool, which managers can use alongside Porters value chain.

By iMeeta © 2012